Today marks the start of a new era for vehicle ownership in New Zealand.

Your gas-guzzler (or diesel…whatever floats your boat) will cost you even more now. Instead, purchasing an EV, hybrid, or clean car will save you a bit of cash.

Even today, most Kiwi motorists have a minimal idea of what the Clean Car Discount actually means for them.

Put simply, new and used cars will incur either a rebate or fee when first registered in New Zealand. Buying a second-hand Mazda2 from the side of the road won’t incur any penalty.

Registrations of ‘heavy emitting’ vehicles have had a big increase in the last few weeks as consumers and dealers snuck in before today’s deadline.

“Insane numbers,” a vehicle inspector told NZ Autocar.

But from today, most vehicles that emit more than 193g of CO2 every km will be penalised. ‘Most’ because there are a few exceptions.

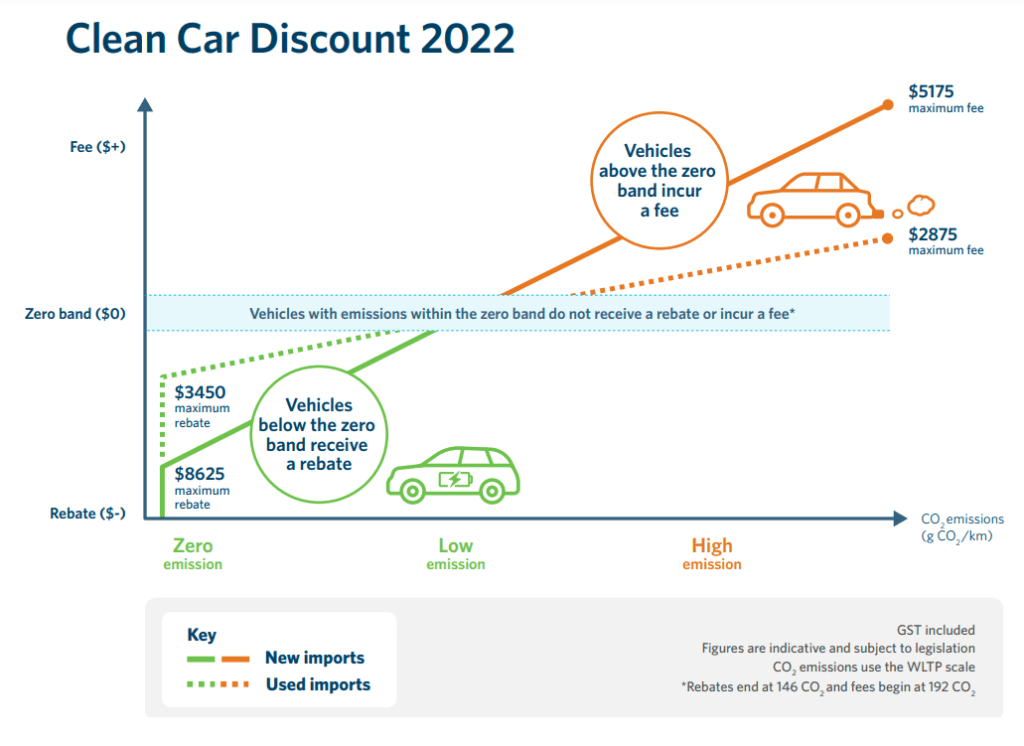

The penalty is determined on a sliding scale and capped at $5175. Cars at this end of the stick include a Ford Mustang GT, an MC20 and an Audi R8. You know, the cool, loud ones.

Used cars that are heavy polluters have a fee capped at $2875.

Cars that emit between 147 and 192g/km fall into a ‘zero band.’ These vehicles have neither a rebate nor a fee.

Finally, anything emitting less than 147/kg receives a rebate. Like the fee, this is determined on a sliding scale.

A brand-new fully electric car could receive a maximum rebate of $8625. A second-hand import can get up to $3450.

There are a few other things to remember about getting the rebate. First, the car cannot cost more than $80,000. Second, it must have a minimum of a three-star safety rating on the Right Car website.

Drive Electric chair Mark Gilbert expects EV registration numbers to begin soaring through the roof.

“We only expect demand to accelerate from there.

“Every day, more New Zealanders are considering the shift to EV. EVs can be fuelled for the equivalent of 30-40c per litre of petrol.

“Naturally, pure EVs produce no emissions. The shift makes sense.”

The government has $301.8 million set aside for the rebate fund. If the fund runs dry, no rebates will be given until the scheme restarts at the start of the next financial year (April 1).