Petrol Cars Likely Moving to RUCs from 2027

Words NZ Autocar | Images NZTA, Pixel

Petrol cars may be hit with road user charges (RUCs) from 2027, if the Government overhaul of land transport funding deems it necessary. Petrol prices may not come down if RUCs are removed from fuel costs because the Government had earlier signalled a 12c per litre tax hike in 2027.

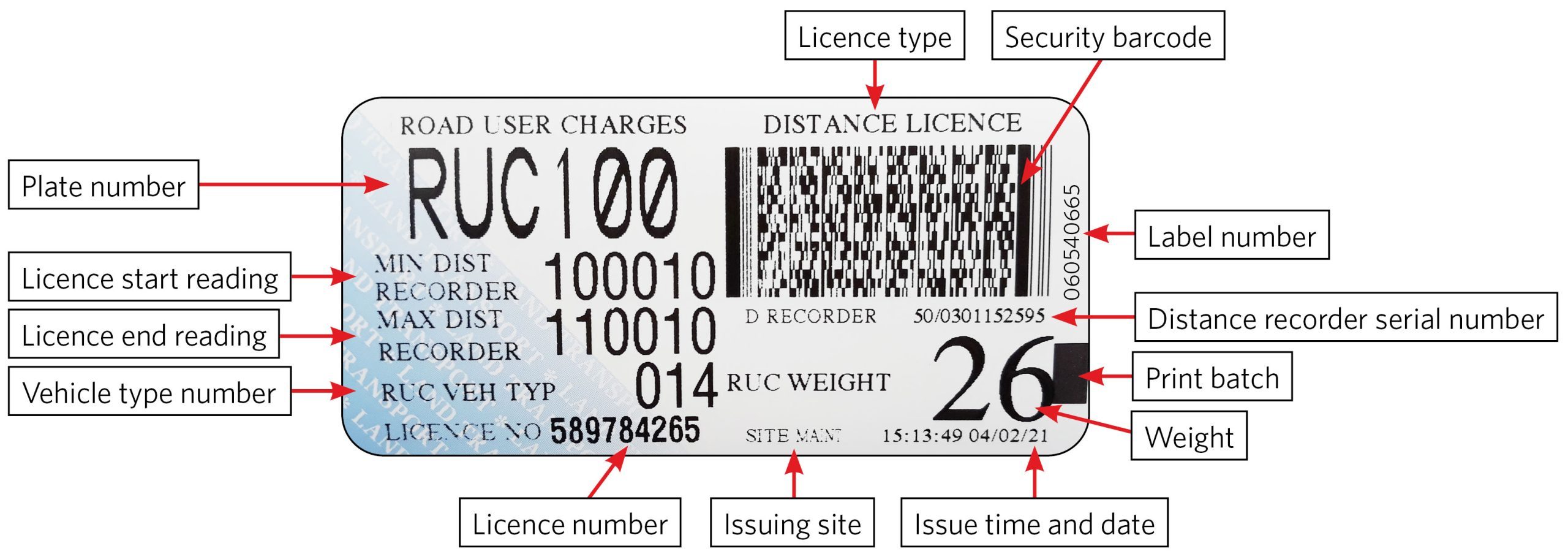

Road construction and maintenance gain funding from the National Land Transport Fund (NLTF). That revenue comes via petrol taxes, and also RUCs paid by drivers of electric and diesel vehicles.

At a recent conference Transport Minister Simeon Brown announced a roadmap for moving all light vehicles to the RUC system and away from fuel tax.

According to the new ‘Revenue Action Plan’, legislation will pass next year with a likely start date to petrol RUCs set for 2027.

Brown explained that the transition would ensure all road users were contributing fairly to road upkeep.

He said “When users pay for a service, they aren’t just participants. They become customers, and customers naturally expect and demand the highest level of service.”

Whether or not the Government’s signalled 12c per litre tax hike for petrol in 2027 comes to pass is unclear at this point. Brown told RNZ that it had not yet been finalised.

Cabinet was also planning to increase tolling next year, Brown said, in the shift towards “user-pays”.

“We expect that [the Transport Agency] NZTA will consider tolling to construct and maintain all new roads, including the Roads of National Significance (Rons), and that the Government will support all recommendations.”

NZTA will soon begin consultation on tolling proposals for several North Island roads of national significance.

Brown said “These corridors offer significant benefits for Kiwis and freight, and it makes sense for those who benefit to contribute towards these projects.”

He added that the existing funding model was not “fit for purpose” and needed significant reform to provide certainty for the funding of infrastructure.

“The NLTF is under increasing pressure and is not sustainable. Taxpayers have had to top up the fund and take on more debt just to pay for the infrastructure they need.”

The Government has also indicated further use of Public Private Partnerships (PPPs), and targeted rates to fund infrastructure.

The National-Act coalition agreement included a commitment to “work to replace fuel excise taxes with electronic road user charging for all vehicles, starting with electric vehicles”.

In March, the coalition passed legislation requiring EVs and plug-in hybrids to pay RUCs.